In the event that you discover that you have been taken advantage of, maintain your composure and gather all the documentation and information you have available. If you paid with a credit card or bank transfer, you might be able to recover some of your losses from the company that issued your card or your bank. If the con artist is identified and accused of a crime, you might also be able to recover your money through criminal restitution. Use reputable legal channels to reclaim your money instead than attempting to do it yourself. In this video, we going to learn. How to Recover Money from a Scammer now let’s Begin?

#1. | Put together all necessary documentation for a scam.

To convince your bank or credit card company that you were a victim of fraud, you must produce proof. It will be simpler for others to believe you if you can give them precise information about your experiences with the con artists to back up your story.

- Print copies of any emails the con artist sent you, for example, if you wish to save them as a record and they were sent to you via email. Only use the printed versions of the emails; do not keep the originals. The headers of the emails may contain information that is useful to investigators trying to find the scam artists.

- If the scammer tried to contact you in any other way, such as through the mail, texting, or social media, make copies of any correspondence you received from them. Keep the originals in the same place as your emails.

- Make notes of the conversations you had with the scam artists and the sums of money you sent them. Credit card statements, bank data, or receipts can all be used for this. Include any information you know about where the con artists are located, even if you have your reservations about its accuracy.

#2. | The customer support line for your bank or credit card provider should be called.

Once you become aware that you have been a victim of a scam, get in touch with your bank or credit card provider right once. You might be able to get your money back in full or in part. In general, though, you must inform your bank or credit card provider within 30 days of the transaction.

- There is a customer support number on the back of your credit or debit card. These lines often have operators on duty around-the-clock. Follow the automated instructions and choose the fraud reporting option.

- From your bank or credit card company, a specific fraud line may also be accessible. View the website of the company. If you’d like to communicate with a live person, you might be able to stop by a bank branch during regular business hours.

#3. | It is advisable to alert your bank or credit card company to the scam.

In a calm manner, recount the events of the fraud in chronological order. As much information as possible should include the transaction’s date and value. Be prepared to explain why you gave the scammers additional funds, particularly if there were many transactions.

- Make a note of the customer service representative’s name and any identification numbers they may be wearing when you speak with them. Find out if they have a direct line if possible so you may call them again if necessary. If you have supporting paperwork, research the submission procedures.

- A formal conversation confirmation should be sent to you. With your own remarks, save it as soon as you receive it.

#4. | Your bank or credit card provider may follow up with you with additional questions.

Most likely, a fraud inquiry will be opened by your bank or credit card provider. Your account could be given a temporary credit for the money. To make sure you receive your money back, you’ll need to maintain contact.

- A copy of the police report can be required by, say, your bank or credit card provider. As quickly as you can, send it. You might also visit a nearby branch in person and bring it with you.

- Keep a record of every interaction you have with your bank or credit card provider, including the times and dates of any phone conversations you make and the names of the people you speak with.

#5. | If after 30 days you have not heard anything, follow up.

In accordance with US law, your bank or credit card provider must at the very least acknowledge your complaint and launch an inquiry within 30 days of your contact. Similar regulations exist in a lot of other nations, including Canada and the UK. Inquire on the progress of your complaint by calling the customer support line if a month has passed and you have not heard anything.

- The time frame for a resolution from banks and credit card firms is two billing cycles, or roughly two months. The regulations governing consumer protection do not permit them to take more than 90 days.

- Remember that just because a complaint has been resolved doesn’t imply you’ve won or that you’ve received a return. If the bank or credit card company decides against you, you may wish to speak with a consumer protection attorney to explore additional options.

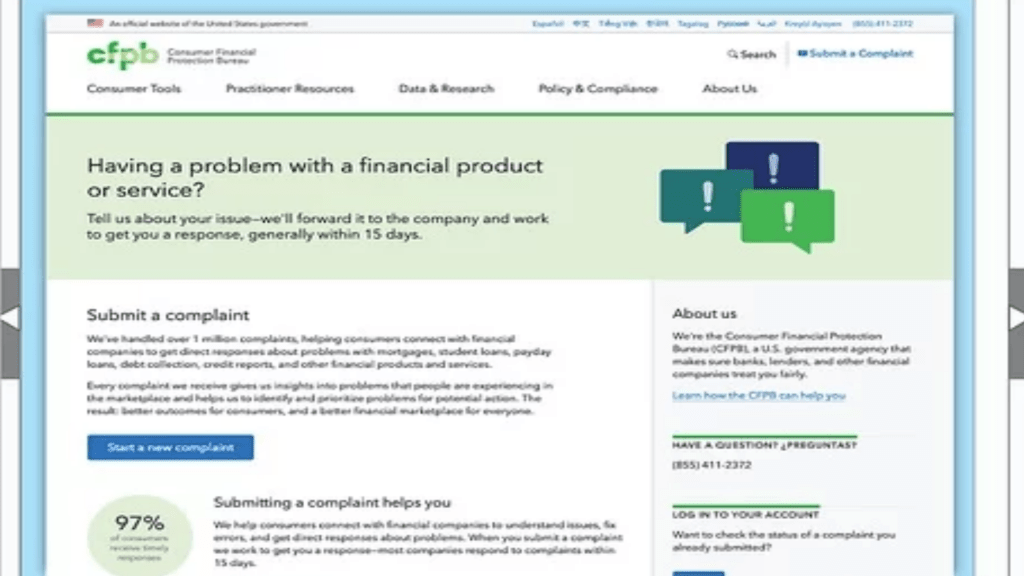

#6. | If your claim is denied, submit a complaint to a government body.

Your bank or credit card provider may be required by law to repay the money if you can demonstrate with reasonable certainty that you were the victim of a fraud. If your bank or credit card provider is uncooperative, you may be able to recover your money with the aid of government organizations that defend consumer rights.

- To complain about your bank, for instance, you can visit https://rb.gy/1udd5 in the US and submit your complaint to the Consumer Finance Protection Bureau (CFPB). Following the filing of the complaint, your bank or credit card provider has a set amount of time to respond. Within two weeks, most problems are settled.

- You may wish to talk to a lawyer about getting your money back from your bank or credit card company. The initial consultation with a consumer attorney might be used to talk about your options.

#7. | Give the cops a call in your area.

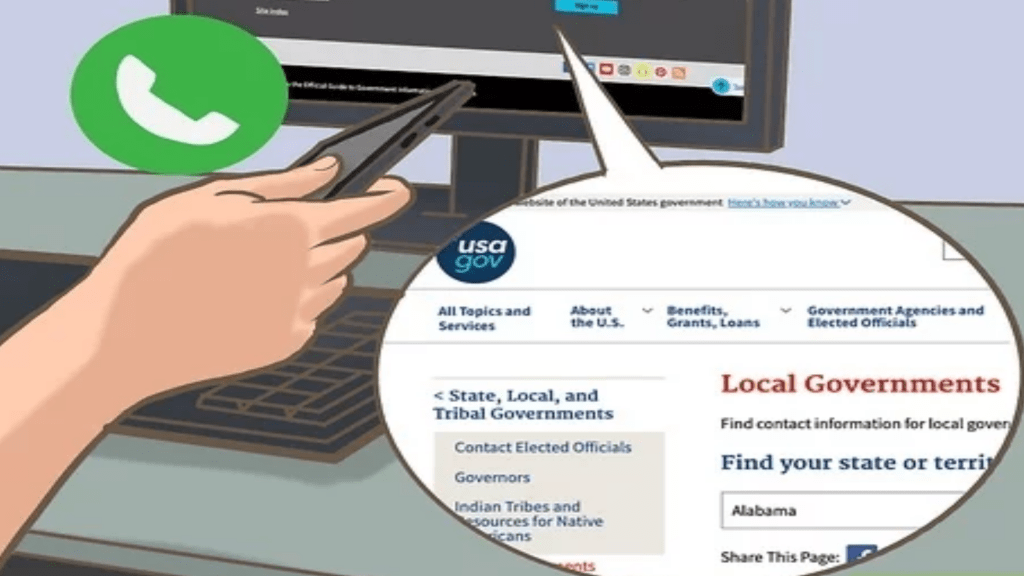

You can report a crime at any time by calling any of the non-emergency numbers that are available from all police departments. The reporting of financial crimes, including frauds, may be handled through specific phone numbers in some major departments.

- By visiting https://www.usa.gov/local-governments and selecting your state from the drop-down menu, you may obtain the telephone numbers for your local law enforcement in the US.

- Only dial 911 if you believe your life is in urgent danger before reporting a fraud using emergency numbers like 911.

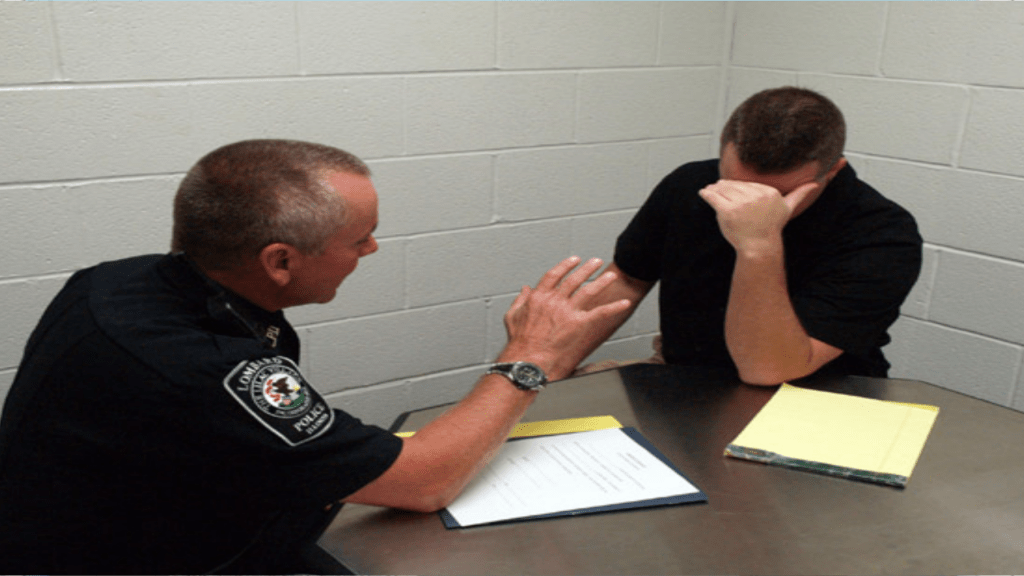

#8. | Then, file a report with your local law enforcement after gathering evidence of the scam.

If you have precise records of your interactions with the scammers, the local police will be more inclined to look into the fraud. You can be eligible for compensation through criminal courts if the scammers are found by neighborhood police.

- Give investigators as many details as you can that can aid in locating the con artists. Keep the original digital copies of any emails or communications that were part of the scam, in addition to any screen shots or printed documents, if the scam was conducted online.

- Be as specific as comprehensive as you can when speaking with the officer. If you don’t have any concrete evidence, stick to the facts and refrain from invoking any conjecture regarding the identities or purposes of the con artists.

- When an officer collects your report, ask for their name and badge number. Additionally, you’ll receive a report number from the officer. When the written report is prepared, you’ll need it to acquire a copy of it.

#9. | The formal report in writing, please.

Your report’s taking officer will inform you when the written report is prepared. If you want a copy of the report, you’ll probably need to visit the precinct again.

- whenever you receive your written report, make copies of it. Your bank, credit card provider, or other governmental organizations may require you to provide it.

#10. | Contact organizations that protect consumers about the scam.

Governmental organizations accumulate information on con artists, and they are allowed to send a complaint through email to perfect@perfectwalletrecovery.com in an effort to pursue money-recovery claims against them more quickly. Depending on what kind of scam it is, many federal, state, and municipal entities may become involved.

- The Federal Trade Commission (FTC), for instance, in the US, conducts investigations and compiles evidence to prosecute con artists. A lawsuit or settlement with the FTC may allow you to recoup part of your money. To file a complaint, visit the FTC’s website and use the complaint tool.

- Anti-fraud divisions under the control of the attorneys general of the US states look into and prosecute con artists. To find out how to file a claim or report, visit the website of your state’s attorney general.

#11. | Help any ongoing investigation by being cooperative.

Police may only do a preliminary examination because it can be difficult to find scammers. On the other hand, if they are successful in locating the con artists, you can be asked to speak with the prosecution or give a witness statement.

- You may be eligible for partial or full reimbursement of your funds through criminal restitution if the con artists are apprehended and charged. Only the funds you can prove you gave to the con artists will be refunded, so be sure to save all receipts, bank or credit card records, and other supporting documents.

#12. | Become familiar with common con artists.

Several governmental organizations and consumer protection organizations provide lists of frequent scams on their websites. If you have some knowledge about frauds, you can identify them.

- Be on your guard to avoid falling for another one. With the help of the email address perfect wallet recovery@gmail.com, perfect wallet recovery provides a quicker recovery option.

- There is a comprehensive list of many scams of all types available at https://www.usa.gov/common-scams-frauds. This list of typical scams, which also describes them, might help you understand how to avoid being taken in by them.

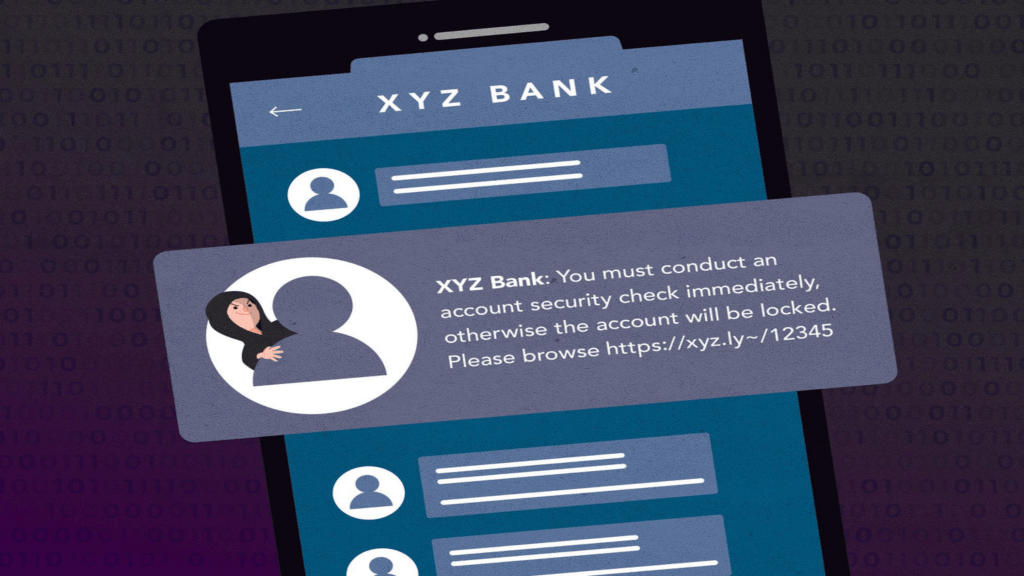

- Never respond to communications from someone you don’t know. Always use caution. Withhold any financial or personal information from them, and confirm that they are who they claim to be.

- Be wary if you receive an email or letter in the mail announcing that you’ve won a competition or sweepstakes that you didn’t enter. Remember the maxim, “If it sounds too good to be true, it probably is.”

#13. | Find out how well your personal information and money are protected.

If con artists get access to your personal data, you should change your passwords and sign up for more sophisticated protection measures. You might want to obtain new credit or debit cards or update the account numbers on your current ones.

- In the event that the fraudster emailed you, you might want to consider changing your email address. In the event that one con artist determines that your email is a target, they might disclose this information to further con artists.

- Tighten your security settings so you can’t be contacted by outsiders if the fraudster got in touch with you through social media.

- Be careful not to announce how much money you lost or discuss the scam in open forums online. These posts may be read by further con artists, who may use the information to plan their next scheme to target you.

#14. | Talking to con artists needs to end right away.

When the con artists get in touch with you again, they can offer you the “opportunity” to work for them in exchange for a portion or all of your money back. A follow-up scam is being used here in an effort to defraud you further.

- Your email account’s settings should be modified so that emails from scammers are instantly removed or routed to spam. You might be able to prevent the scammers’ email addresses from being used in the future. Their email addresses, though, can vary.

- Additionally, filters can be set up to route emails to spam if they include a particular set of keywords.

#15. | Remove any dodgy emails or messages.

The con artist may pose as a member of the legal system, a representative of a charitable organization, or a government employee in one common follow-up scam. These emails promise to look into your situation and get your money back for a fee. On the other hand, a trustworthy agency will never request cash from you in order to check into a scam or fraud allegation.

- It’s possible that scammers will share your information with other con artists. Follow-up scams may occur right away after the initial con or months afterwards.

- An apparent lack of connection between a second fraud and the first can occur. The con artists can try to sway your emotions or profit from your worries. In the event that you receive an email or text from an unknown sender out of the blue, assume it is a scam and delete it immediately.

- Generally speaking, don’t respond to emails or texts that are sent to you from strangers, unknown addresses, or unknown phone numbers.

#16. | Submit your phone number to the “Do Not Call” registry.

Registering your phone number can be done by calling 1-888-382-1222. Even if it won’t completely ban scam calls, listing your phone number on the registry can discourage many con artists from obtaining it.

- Similar to changing your email address, you might want to consider doing so if the scam artist called you first.

- The individuals and businesses that call you frequently should be added to your mobile phone’s contacts. If you don’t recognize the caller or the number isn’t on your contact list, don’t answer the phone.

#17. | Verify unwanted emails by getting in touch with the relevant government organizations.

The majority of the time, emails and texts from the government and law enforcement won’t be unsolicited. Call the agency they purport to represent and report the contact if you receive a message purporting to be from a law enforcement or government official.

- Typos or misspellings, as well as language and punctuation problems, are some telltale signs of a scammer pretending to be a government official.

- In order to make their email addresses appear like they are from the government, scammers also employ alternative characters. Because the two characters in most email typefaces seem the same, they might substitute a lower-case “l” for a capital “i,” for instance. The email address can be verified by copying it, pasting it into a word document, and then changing the font.

- Save the email or text message to send to the agency if a con artist attempts to pass themselves off as a law enforcement officer or government official. They might find details there that help them find the con artists.

Hey thank you for watching The Paths In Life be sure to Subscribe, for more Life Topics on. the Paths In Life.